How To File Income Tax Lhdn

If you have other tax-related concerns to clear up do also check out our step-by-step income tax guide for 2021 YA2020 here. Fastest tax refund with e-file and direct deposit.

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

15 to issue a refund to taxpayers who claimed either of those credits.

How to file income tax lhdn. Additionally we have other income tax content available for your reference such as information on the tax reliefs that you can tap into this year filing your taxes for the first time and the special tourism tax provided for your hotel stays last year. According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. If you dont file and pay your taxes you could face some consequences.

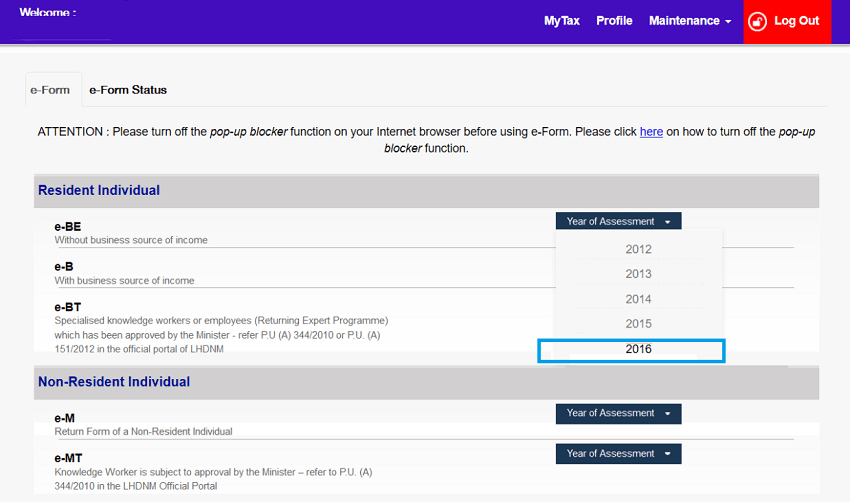

Individual Income Tax Return electronically using available tax software products. Fastest refund possible. This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness.

For instance salaried individuals are usually required to file their income tax returns by the 31st of July whereas Corporates covered under audit can file their returns by 31st September of the assessment year. According to the law the IRS has to wait until Feb. In both cases annual income of up to Rs25 lakh is tax free.

Tax refund time frames will vary. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically. 730 am - 530 pm.

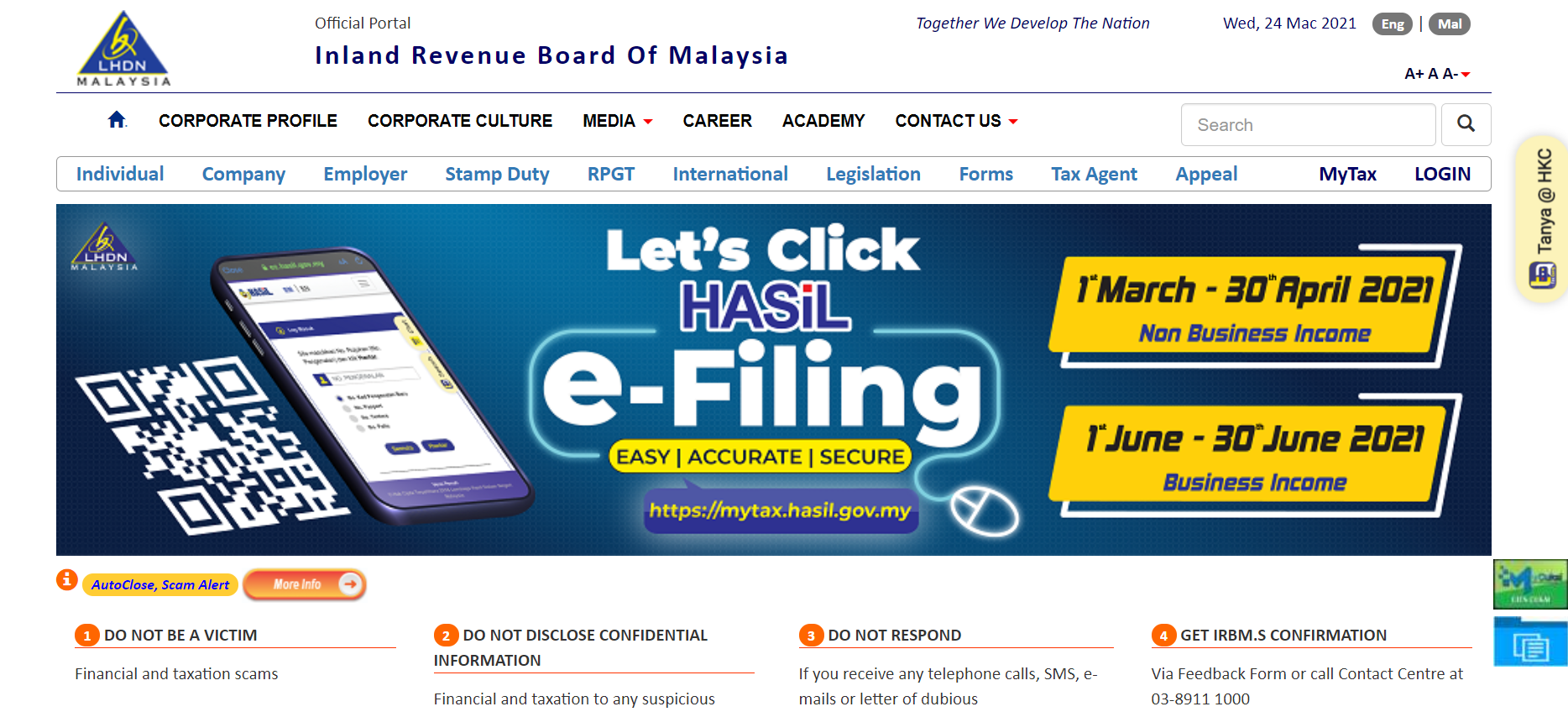

Additional qualifications may be required. Pay for TurboTax out of your federal refund. E-Filing For Income Tax Starts On 1 March 2021 LHDN Inland Revenue Board has recently released the Return Form RF Filing Programme For The Year 2021 on its website which listed all the file types due dates grace period and filing method for your references.

Before amending your return if you received a letter regarding your premium tax credit or Form 8962 you should follow the instructions in the letter. 03 - 9207 4200 Fax. If you file on the early side and claim the earned income tax credit EITC or the additional child tax credit ACTC you will have to wait a bit for a refund.

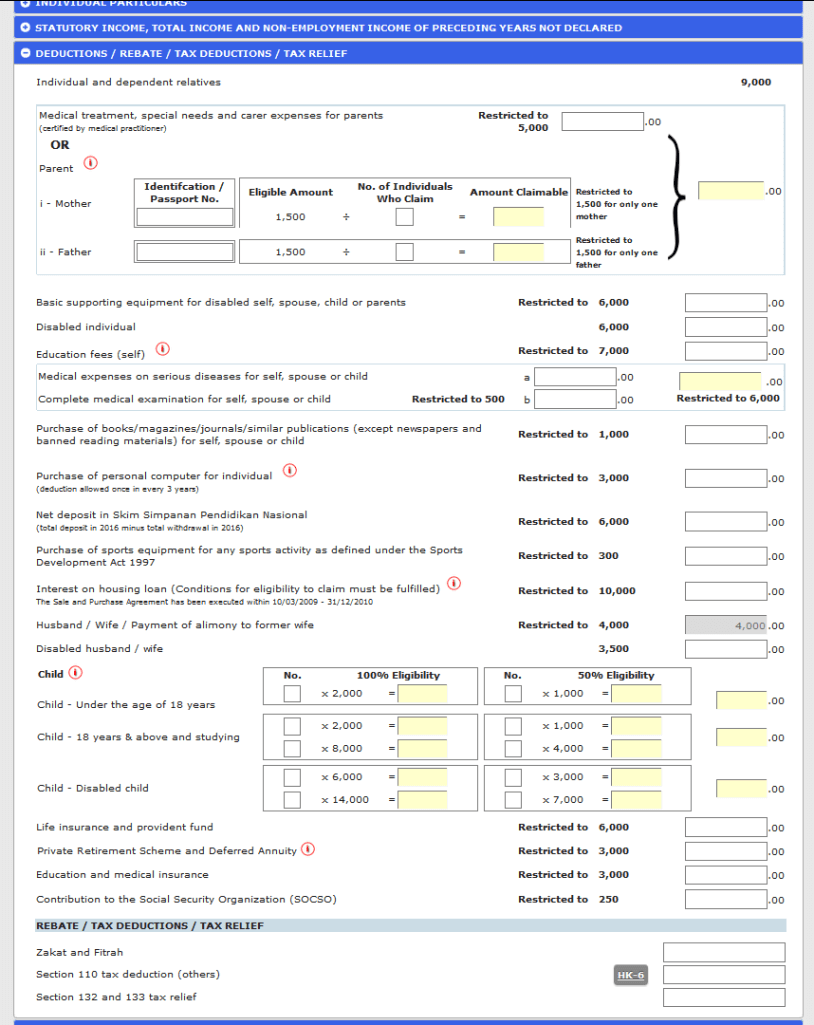

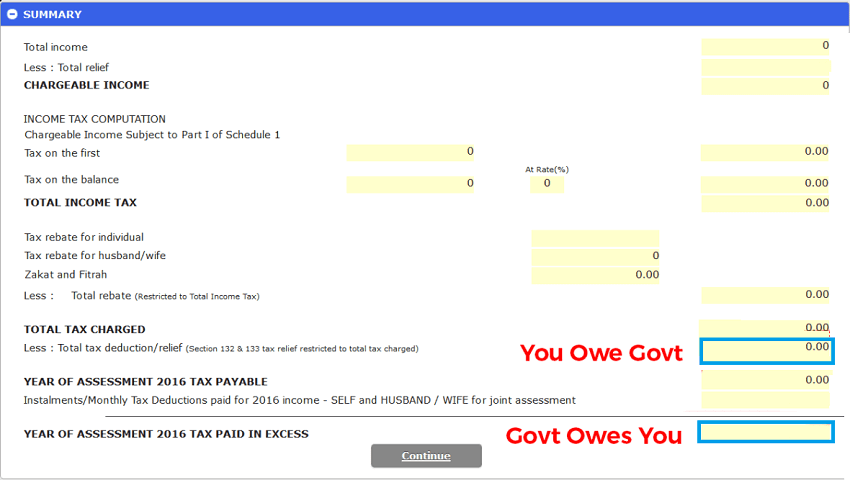

Automatic tax relief of RM9000 every time you fill out the LHDN e-Filing form. Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a. Below is the list of tax relief items for resident individual for the assessment year 2019.

Income Tax and RPGT payment at Maybank Berhad - Kawanku Phone Banking 1-300-88-6688 Income Tax payment through mobile phones at Bank Islam - i-TAP Mobile Banking Individual Tax Only. Payment via Cash Deposit Machine CDM Payment of individual Income Tax and Real Property Gains Tax RPGT as listed below can be made via CDM at Maybank. Monday - Friday.

Prices are subject to change without notice. You can file IRS Form 4852 a W-2 substitute if the tax-filing deadline is looming and you still dont have your W-2 but this can be a bit of a headache. There are two different tax regimes which are currently used in India to file income tax returns.

Find Content Updated Daily for free tax filing online. To make it easier for you to plan manage and file income tax the following is a list of tax reliefs divided into several main categories. 03 - 9287 5466 Office Hours.

Payment of income tax through monetary transfer using bank draft requires the payer to submit the following instrument. It is important for all taxpayers to remember the due date of filing income tax returns. Youll have to accurately calculate your earnings and withholding amount based on your final pay stub for the year so you might want to reach out to a tax professional if you find yourself in this situation.

So how to file income tax. Personal tax relief Malaysia 2020. The relief amount you file will be deducted from your income thus reducing your taxable incomeMake sure you keep all the receipts for the payments.

Find Content Updated Daily for free tax filing online. Ad This is The Newest Place to Search Delivering Top Results from Across the Web. A 40 Refund Processing Service fee applies to this payment method.

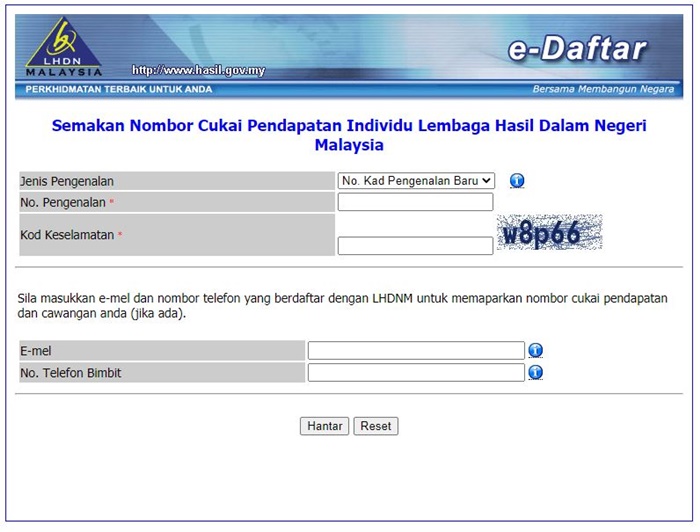

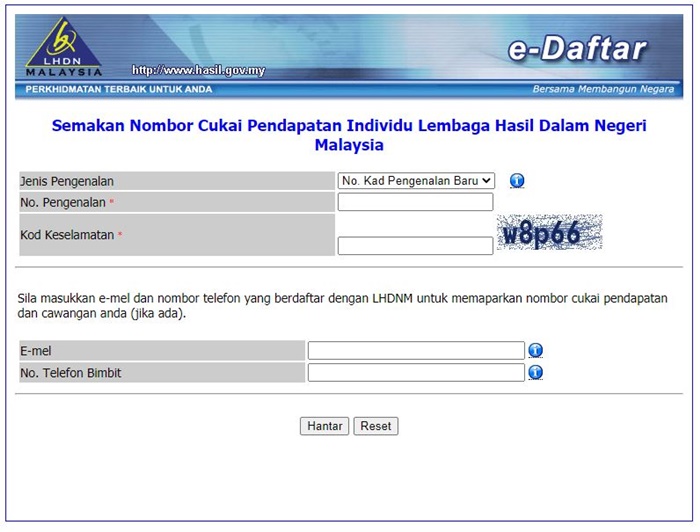

Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN. Director General of Inland Revenue Name and address of payer bank. The IRS issues more than 9 out of 10 refunds in less than 21 days.

The following is LHDNs official income tax report for 2021 For more details please visit LHDN official website. Ad This is The Newest Place to Search Delivering Top Results from Across the Web. Mediatory LHDN E Filing Employers are required to complete Form E filing 2021 via electronic registration.

Income Tax Course. The tax filing deadline is Wednesday July 15. However the tax-free income is the same on the basis of both the old regime and the new regime.

LHDN Cheras Branch PGRM Level 8-12 Menara PGRM 8 Jalan Pudu Ulu Cheras 56100 Kuala Lumpur. 21 July 2021 New submission deadline for Form P B extended from 15 July to 31 Aug 2021. You can now submit the Form 1040-X Amended US.

Please see IR-2020-107 and IR-2020-182 for additional information. Enrollment in or completion of the HR Block Income Tax Course is neither an offer nor a guarantee of employment. The due date varies on the basis of taxpayers.

Individual and dependent relatives. Deadline for Income Tax Return in 2021 Whether it is working or doing business for tax safety the most important thing that cannot be ignored is tax declaration and tax payment From March 1st the income tax of. Must be local paying bank or local correspondence bank so that the draft becomes a local cheque.

However you may be required to purchase course materials. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year. There is no tuition fee for the H.

You filed an income tax return and failed to file Form 8962 Premium Tax Credit to reconcile your advance payments of the premium tax credit.

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

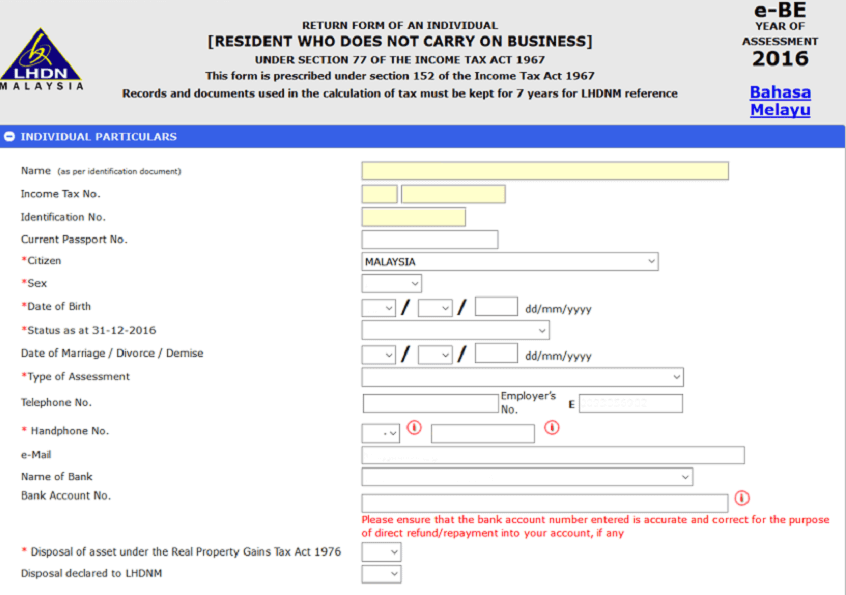

Ctos Lhdn E Filing Guide For Clueless Employees

Https Ez Hasil Gov My Ci Panduan Latest Panduanci Eborang E 20v3 3 Pdf

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Ctos Lhdn E Filing Guide For Clueless Employees

Https Ez Hasil Gov My Ci Panduan Latest Panduanci Eborang E 20v3 3 Pdf

Ctos Lhdn E Filing Guide For Clueless Employees

Https Ez Hasil Gov My Ci Panduan Latest Panduanci Eborang E 20v3 3 Pdf

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

Ctos Lhdn E Filing Guide For Clueless Employees

Posting Komentar untuk "How To File Income Tax Lhdn"